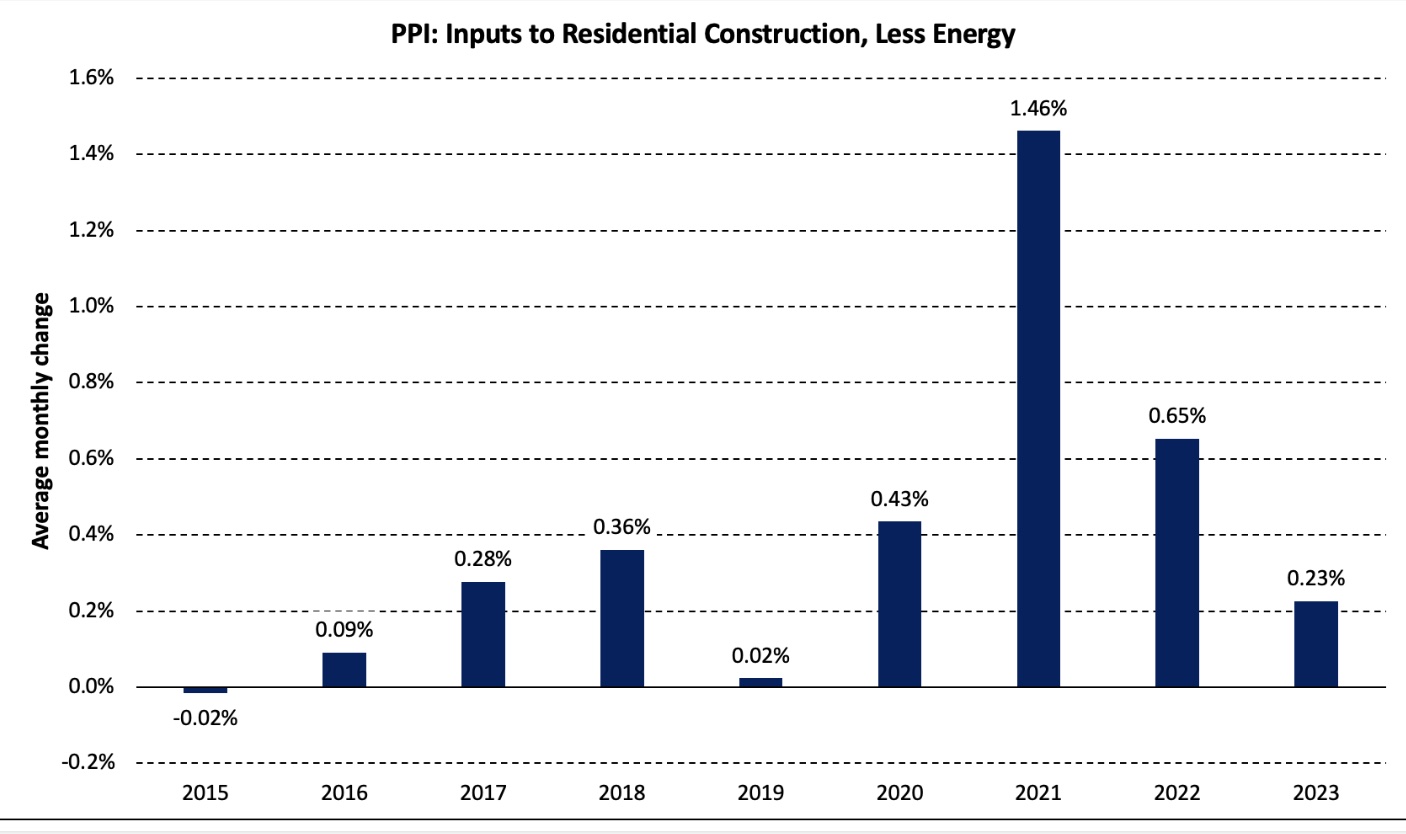

The Building Construction Price Indexes (BCPI) are quarterly series that measure change over time in the prices that contractors charge to construct a range of new commercial, institutional, industrial and residential buildings. These buildings include 6 non-residential structures and 5 residential structures.

The series is limited to non-residential and residential building construction in 11 census metropolitan areas (CMAs) including St. John’s, Moncton, Halifax, Montréal, Ottawa-Gatineau (Ontario part), Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, and Vancouver. A composite of these 11 CMAs is also provided.

The CMA level weights used in calculating the most recent reference period is based on a three-year moving average of building permit values issued for residential and non-residential building construction, for each of the selected buildings, in each of the 11 CMAs observed.

The BCPI is subject to a one quarter revision and is not seasonally adjusted.

+